Hey, I'm Steph Blake 👋

I'm the best at helping online business owners run simple, streamlined & profitable businesses in <20 hours/week!

I'm the best at helping online business owners run simple, streamlined & profitable businesses in <20 hours/week!

🔒

Unlock THE VAULT

Lifetime Access to Everything You Need to Simplify Your Business in ONE Place!

Get the step-by-step blueprint to simplify your business for FREE!

Get step-by-step blueprint to simplify your business for FREE!

WANT A FREE WORKSHOP? 😉

How to Simplify the Systems In Your Business

In this free, interactive workshop you'll learn how to:

👉 Streamline your systems & tech

👉 Create simple automations

👉 Make selling easier

👉 Future-proof your business

...and so much more!

Feedback from a few people I've helped 🫶

How can I help you simplify your business?

Simple Business School™

All-inclusive membership that gives you everything you need to run a simple, streamlined & profitable online business in 20 hours per week (or less).

Anonymous, Weekly Coaching

Your questions, answered anonymously, every week via a private podcast feed — with actionable advice tailored to you!

Automation Accelerator

6-week, high-touch program to help you identify, implement, and optimize the right automations in your business!

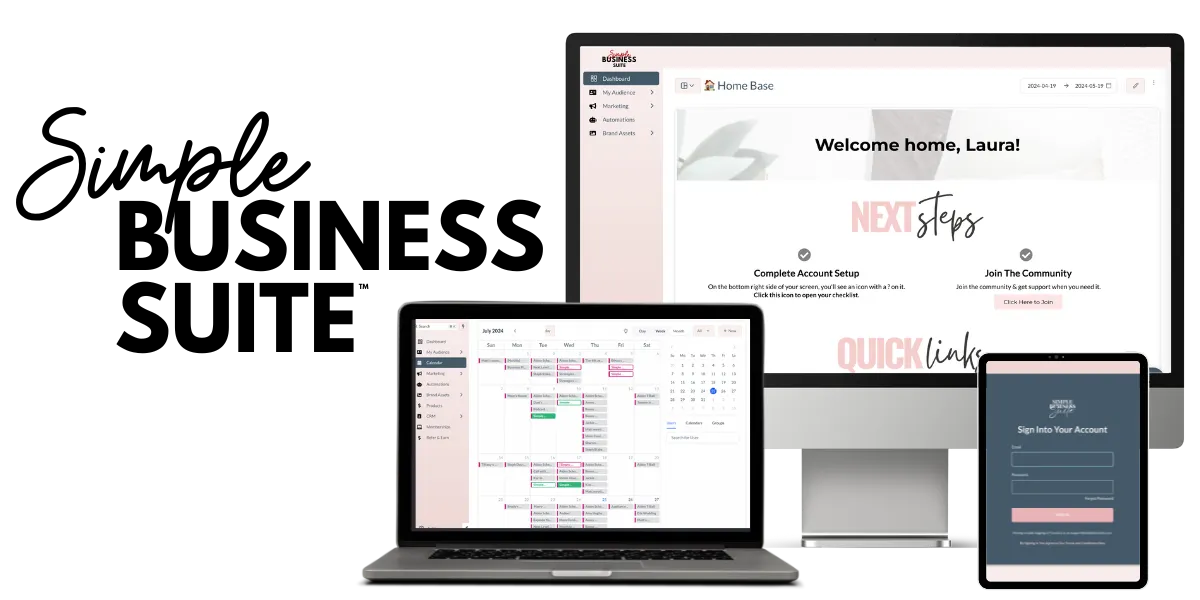

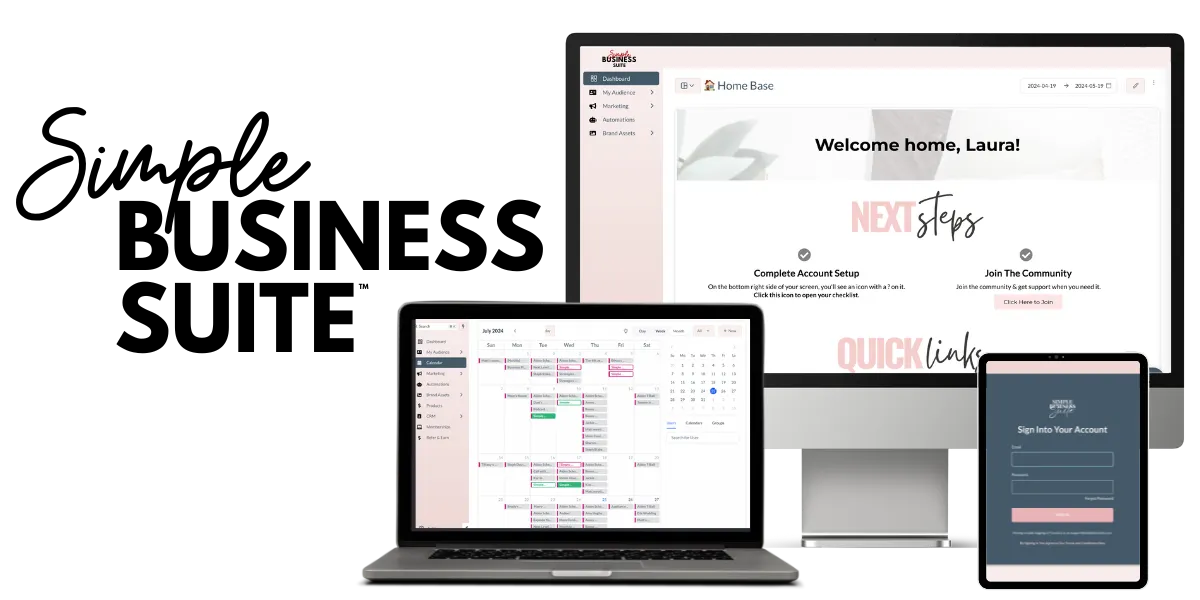

Simple Business Suite™

Customized, all-in-one solution created by Steph that helps small business owners simplify their software so they can focus on doing what they love.

Get unlimited access to everything you need to run your online business in ONE place and save hundreds (or thousands) of dollars every month!

Simplify Your Business Bundle

Everything you need to simplify your business - strategy, software and tech!

Perfect for entrepreneurs who are serious about simplifying every area of their business!

Small Group Mastermind

Designed for driven entrepreneurs who want deep, focused support and fast breakthroughs to simplify their businesses and reach their goals.

Private Day of Support

By the end of the day, you’ll have greater clarity, improved strategies, and the confidence to move forward!

One-Time, Private Call

Perfect for the person that needs an expert to connect with and get clarity, without an ongoing commitment .

In Person Events

Build real connections and get hands-on support to see the things you've been missing or struggling with on your own.

You'll walk away with the clarity and confidence to take your next steps—faster than you ever thought possible.

Listen To the Podcast

We're peeling back the curtain and showing what it takes to run a simple & profitable online business.

Every week you'll hear stories & strategies from my guests & I to help you simplify your business.

In this podcast, we're peeling back the curtain and showing what it takes to run a simple & profitable online business.

Every week you'll hear stories & strategies from my guests & I to help you simplify your business.

"

When I found Steph, I had already spent 8 months searching for how to grow from an unprofessional blogger to a professional, recognizable business in my industry.

No one seemed to offer that 'secret sauce'—the guidance you need when you're trying to grow, but don't have enough time to do it all yourself or the money to hire help.

When I saw a bundle that she hosted, I immediately thought, 'This is the woman I need to learn from.'

And I was right!

Steph provided exactly what I had been searching for all year but couldn’t find anywhere else.

She’s been the missing piece I needed to take my business to the next level!"

MICHELLE DEAR MONCRIEF

MICHELLE DEAR MONCRIEF

Blogger & Membership Site Owner

Blogger & Membership Site Owner

Hey, I'm Steph Blake 👋

I'm that crazy woman who is obsessed with working less than 20 hours per week & making a full-time income 🤪

...AND I WANT TO HELP MAKE THAT POSSIBLE FOR YOU TOO!

It's really easy to fall into the trap of overworking & not getting the results you want.

With over 20 years of experience in marketing and 10 years running my own business, I’ve been there—I worked the 80+ hour weeks chasing the elusive “6-figures per year” goal.

But when I found out I was pregnant with my first son, I realized that I needed to figure out a way to leave my 9-5 job and go full-time in my business.

So I created a SIMPLE solution that my ADHD brain could understand & implement...quickly!

For the past 6 years, I have taught this method to thousands of people, retired my husband in early 2022 from his 9-5 job & consistently work <15 hours/week while making 6+ figures.

Business Consultant, Serial Entrepreneur, Podcast Host, Systems Nerd, Boy Mom (x2), Wife, Amazon Prime Addict

Weekly Newsletter

Join 11K+ online business owners & get actionable resources and strategies to help you simplify your business in your inbox every week...

....with some fun surprises mixed in 😉

Join 10K+ online business owners & get actionable resources and strategies to help you simplify your business in your inbox every week...

....with some fun surprises mixed in 😉

"

How do you thank someone who stopped you from giving up on your business and helped you discover your true purpose?

For years, I was held back by a missing link that I couldn’t identify—until I worked with Steph Blake.

She helped me find it in a Mastermind where we shared our businesses, fears, and mindsets in a safe, supportive space.

Despite never having met Steph before, the experience was transformative. I’ve worked with countless coaches and invested significant time and money without seeing results, but none understood my mission and passion like Steph.

She grasped my "why" almost better than I did.

What makes Steph unique is how much she truly cares. She listens deeply and finds the simplest, most effective strategies to help you start or scale your business.

Thanks to Steph, I now believe I can build the business I’ve always envisioned. The outcome exceeded my expectations.

huguette charles

Momcierge Event Planner & Professional Mascot

Follow Along on Instagram

@theblakecollective

Favorite Blog Posts

How to Decide Between Creating an LLC or Corporation For Your Business with Roger Pearson

"At the end of your days, the thing is not what you've achieved but how many people you've improved their lives." - Roger Pearson

Starting or growing a business comes with a myriad of decisions, one of the most crucial being the choice of business structure.

On a recent episode of The Simple Business Show™, I had the pleasure of discussing this topic with Roger Pearson, a business expert with over 50 years of experience in creating, managing, and advising small businesses.

Here's a breakdown of what we covered:

Understanding Business Structures

LLC vs. Corporation

The decision between forming an LLC (Limited Liability Company) or a corporation can have a lasting impact on your business. Both structures offer liability protection, but they differ in complexity and tax implications.

• LLC: This is a state-recognized entity that shields your personal assets from business liabilities. It's often the go-to choice for small business owners due to its simplicity and flexibility. However, it doesn’t change your tax treatment from that of a sole proprietorship or partnership unless additional elections are made.

• Corporation: A corporation is an independent legal entity that pays taxes on its profits. It’s more complex and better suited for businesses planning significant growth or seeking outside investors.

Roger emphasizes that while LLCs provide liability protection, corporations offer a more robust framework for scaling larger operations.

S Corporation: A Strategic Hybrid

For many small businesses, electing S Corporation status can be a smart move. This tax designation allows business income, losses, deductions, and credits to pass through to the owners’ personal tax returns.

One major advantage is the ability to reduce self-employment taxes by designating a portion of income as dividends rather than salary. However, as Roger warns, business owners must follow IRS guidelines on "reasonable compensation" to avoid potential issues.

When to Consider an S Corporation

Roger suggests that business owners with net profits in the range of $40,000 to $50,000 or more should consider switching to an S Corporation.

The savings from reducing payroll taxes can be substantial. However, this benefit comes with added responsibilities:

• Filing separate corporate tax returns.

• Managing payroll for employees, including yourself as the owner.

The extra administrative work is often worth it for the tax benefits, but it’s essential to weigh these factors carefully.

The Importance of Professional Guidance

One of the most critical takeaways from our conversation is the value of professional advice. Roger stresses the importance of having an experienced tax advisor and accountant on your team.

These experts can provide tailored insights, helping you navigate the complexities of business structures while aligning with your goals.

Choosing between an LLC or a corporation is a big decision that can affect your business’s liability, taxes, and growth potential. By understanding the differences and seeking professional guidance, you’ll be better equipped to make the right choice for your business.

WANT TO GO DEEPER?

Listen to the full interview on the Simple Business Show here.

CONNECT WITH ROGER PEARSON

Listen to the Episode

The Simple Business Show™ is a free, private podcast that requires so you won't be able to find it on the podcast platforms.

👉 If you want to get access to this episode and all others, click here to sign up.

Resources Mentioned In This Episode

🖥 Simple Business Suite™

All-in-one business management and marketing tool created by host Steph Blake to simplify your backend systems.

🎓 Simple Business School™

All-inclusive membership from Steph Blake that helps you run a simple, streamlined and profitable online business in less than 20 hours per week.

🫶 Refer a friend to the Simple Business Show™

Know someone who would be interested in learning ways to simplify their business? Invite them to join! Click here to create your special referral link.

🗣 Sponsor the Simple Business Show™

Want to get more eyes on your business? Sponsoring the Simple Business Show™ is a great way to reach tens of thousands of online business owners! Click here to learn more.

🎧 HelloAudio

We're using HelloAudio for this private podcast feed. Click here to test it out and get 2 months free with our special affiliate link.

All Rights Reserved. Copyright © 2025 The Blake Collective, LLC

Privacy Policy | Terms & Conditions | Contact

This page is powered by the Simple Business Suite™